California Insurance Planning

Smart Start Insurance Solutions

Retirement is personal. You’ve worked hard to save and invest your money and now it’s time to optimize and protect your savings to provide for your retirement and your loved ones thereafter.

Smart Start Insurance Solutions is an independent Insurance firm, specializing in helping individuals and families protect what they worked so hard to achieve. Our approach focuses on tailored insurance planning strategies and income protection strategies such as guaranteed lifetime income and asset protection.

Retire with confidence

Our Protection Planning Process

Our three-step planning process works to help identify and implement suitable protection strategies for helping our clients minimize risk and feel more secure about their goals and objectives in retirement.

01

Start Smart

Get a Clear Understanding of Your Financial Life

First, we gain a thorough understanding of your current financial situation, goals, objectives, risk tolerance, and the key considerations that should be addressed in your retirement strategy.

Six Fundamental Protection Planning Considerations

Six key fundamental protection considerations can impact your financial goals now and in the future. The question is not if these will affect your finances, but to what degree. We evaluate your sentiment toward each consideration and quantify the potential effects on your assets over time. This allows us to build customized strategies to help you protect your assets and income from unexpected outcomes.

Longevity

Outliving financial assets as the result of a longer life.

Inflation

Reduction in real purchasing power as the result of increasing cost of living.

Mortality

Loss of financial assets as the result of a partner’s or spouse’s death.

Liquidity

Limited access to assets to meet life’s unexpected financial needs.

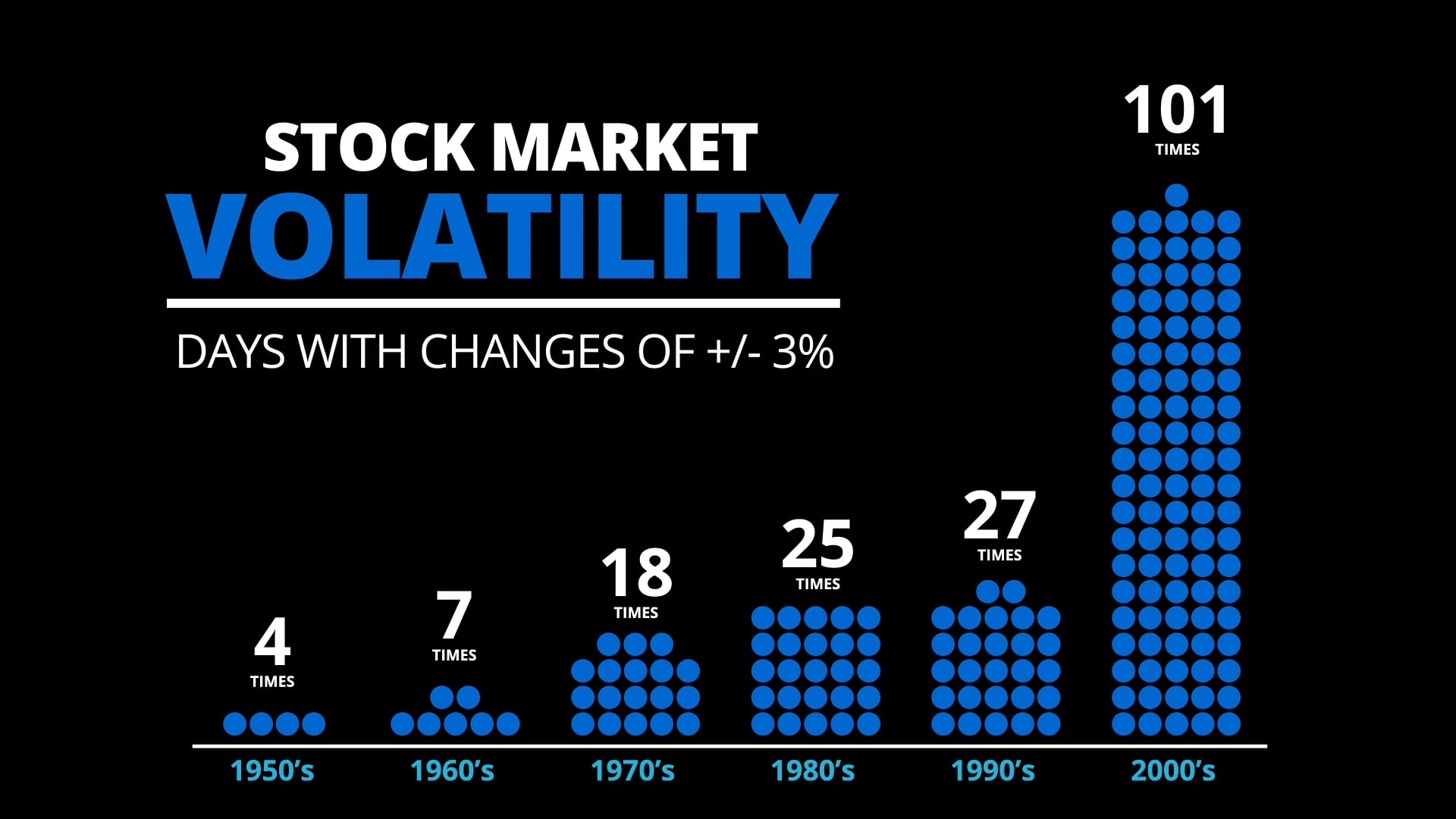

Market

Unexpected reduction in the value of financial assets at the time of withdrawal.

Taxes

Decreasing income and assets and/or the impairment of legacy assets from increasing taxes.

02

Apply Discipline

A Retirement Strategy Designed for You

Next, we design a retirement strategy that actively works to help optimize your wealth and protect your finances, keeping your goals and objectives at the forefront of our planning process.

03

Communicate Progress

Our Commitment to You

Lastly and continually, we work to ensure transparency of your protection plan by providing visibility, proactive outreach, and accessibility to our team throughout our working relationship.

Request Your

Receive Our

Have a Question?

Here For You

Meet The Advisor

Martik Ghookasian

Co-Founder

Life is all about persistency! and that is what has motivated me throughout my

career as an Insurance Broker & Financial Professional for over 15 years.

After graduating with a Bachelors in Business Finance from California State University

Of Los Angeles, I always knew I would one day venture into the world of Finance.

In 2009 I finally took a leap of faith and left the Education Industry to join the world of

Insurance & Financial Planning. After early affiliations with companies such as Prudential & New York Life, I finally decided to venture off independently and create my own Brokerage (Smart Start Insurance Solutions) to help my personal and business

clients with their Life, Health, Disability & Long Term Care needs and have been growing my business ever since. Through my independent journey I was fortunate enough to be introduced & eventually affiliated with the Capstone Financial & Ameritas which I now consider my close family & friends!

When I am away from my work, I enjoy activities such as sports, creating music, traveling and helping animals. I am here to help motivate, share knowledge and care for the world and the people I am blessed to come across and surround myself with; helping people with their financial decision making throughout their journey of life is the most exciting and promising way I could ever imagine applying my skills to.

RR

Retirement Resources

Complimentary Educational Resources

Lastly and continually, we work to ensure transparency of your income plan by providing visibility, proactive outreach, and accessibility to our team throughout our working relationship.

Our Upcoming Events

Events in March 2026

- There are no events scheduled during these dates.

Our Blog

Financial Calculators

PLEASE NOTE: The information being provided is strictly as a courtesy. We make no representation as to the completeness or accuracy of information provided via these calculators. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, information and programs made available through the use of these calculators.